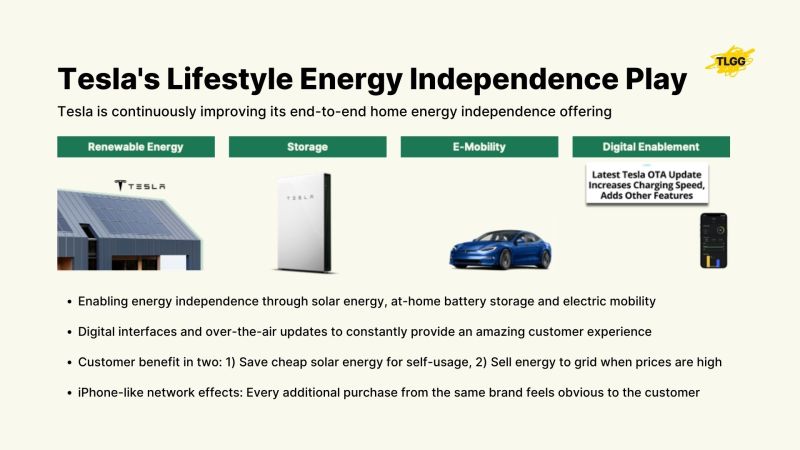

After an overview of the new energy landscape, we can look at how different companies are addressing the opportunity of the “New Energy Ecosystem.” First and foremost, we look at who is arguably the “category creator” in this space: Tesla

Tesla

Tesla is not only a pioneer in electric mobility, it’s also the company that currently builds *the* lifestyle brand around energy independence. While few people were thinking about their household energy consumption a couple of years ago, you can now watch hundreds of videos of Tesla enthusiasts who walk you through their solar roof, storage and EV/charging setup along with how they track everything on their smartphones.

Tesla‘s integrated ecosystem is the most advanced and customer-friendly reflection of the tectonic structural shifts that we analyzed previously in this series. It’s the entrepreneurial and disruptive answer to technological advances, changing customer preferences and shifting political priorities.

Shell

Next, we are examining the energy giant Shell. The company is still deriving essentially all of its profits from the fossil world, and while there is a lot of controversy around the organization, Shell is also quietly building up an impressive portfolio of new energy companies.

Shell has multiple strategic bets across the value chain. It owns virtual power plants, has one of the world’s leading players in battery storage solutions, and is also active in charging solutions. While the current portfolio is already impressive, we believe Shell will face two big challenges moving forward:

- Identifying the best speed of transformation: Shell is constantly facing the dilemma of choosing where to spend each additional dollar of profit: In the cash-cow business of oil or in a still somewhat uncertain “New Energy Ecosystem.”

- Finding ways to connect these acquisition/ investments into a business model or an investment holding company: While the latter seems more likely and easy, it’s the former that would actually foster the kind of synergies we need.

Volkswagen

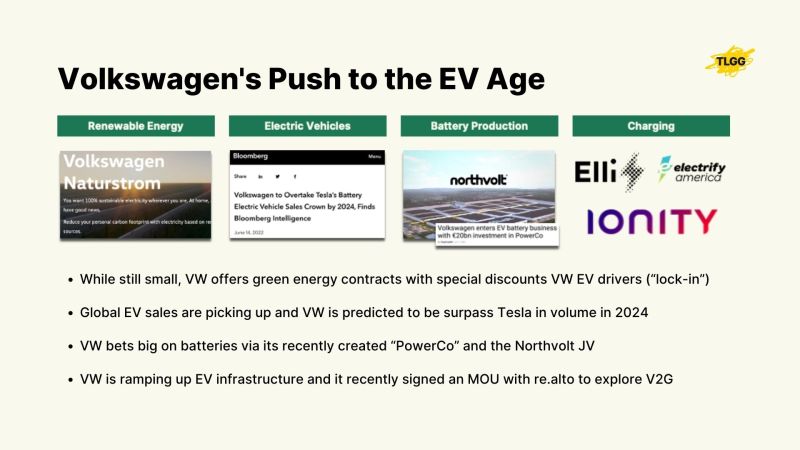

Additionally, The German car juggernaut Volkswagen AG, which seeks to go EV-only in Europe by 2033, is putting essential pieces into play today. Volkswagen is massively betting on owning the battery value pool as a key part of its strategy: For years, VW has been investing into its joint venture with Northvolt and recently created PowerCo SE to unify its battery efforts and it also explores new & innovative concepts such as vehicle-to-grid (V2G).

While the push to electric vehicles (EVs) is projected to deliver short-term milestones such as surpassing Tesla in global EV sales by 2024, the Achilles heel in VW’s efforts is its apparent weakness in building software solutions and business models for the future. However, to win both the race amongst competing OEMs, but also to gain share in the “New Energy Ecosystem,” building strong digital platforms and customer interfaces will become key.

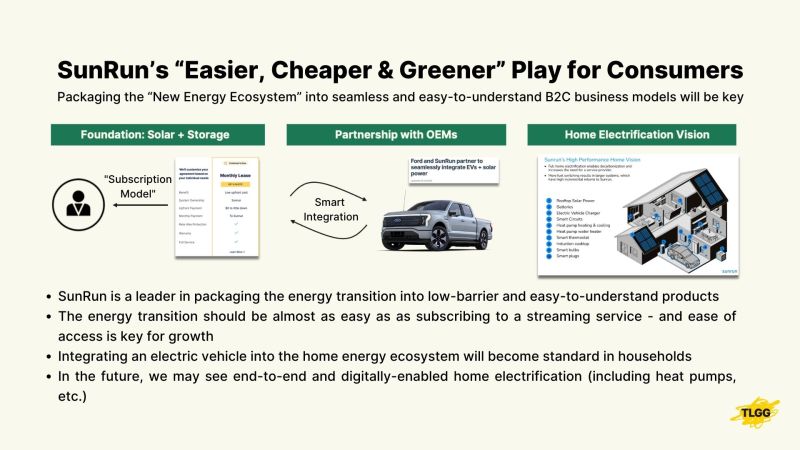

SunRun

An important puzzle piece towards the “New Energy Ecosystem” is electrifying our buildings. The Californian growth company, Sunrun, is a key player in advancing solar energy and battery solutions for residential customers. In many markets and for far too long, getting s solar panel on your roof was a bureaucratic nightmare requiring local permits, the orchestration of local installation companies and getting the financing right.

Faced with these challenges, most people will decide against upgrading their buildings even though they may lose money along the way – the hassle is simply not worth it. Companies, such as Sunrun, Enpal or 1KOMMA5° take out the complexity of this important undertaking by offering much more standardized and easy-to-understand products.

This “packaging” of the energy transition for retail customers is essential to achieve the kind of growth rates that we need to meet emissions targets. Generating consumer demand for a product that is simply superior to alternatives is the best tailwind the energy transition can have. As mentioned before, while we do see consumer demand picking up, issues such as a shortage of skilled labor currently cause massive problems to mass-spread adoption.